How to begin investing in fine art photography

Introduction

Fine art photography is an excellent way to build a long-term investment strategy. Fine art photography investments are unique, and they have many aspects that make them appealing. According to Dollar Sprout average returns on fine art are currently 7.6%, beating the S&P’s average returns over 20-years of 6.4% when adjusting for inflation.

Why Should I Invest in Fine Art Photography?

Investing in fine art photography is a good way to diversify your portfolio. When you buy a fine art print, you are buying art that stores value, not just a piece of paper. In addition, when you buy limited edition prints from artists, and those limited editions sell out, the market value of your print almost always increases quickly as there are no more of these available from the artist. These situations provide the clearest example of how people’s initial investment can more than double when picking up art that becomes much more rare, and therefore more valuable, than when initially invested.

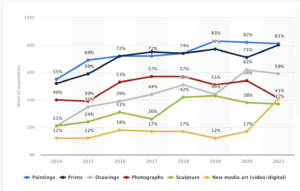

Check out this chart of Fine Art trends provided by statista.com to see how fine art prints are trending over time.

All investments carry risk, but limited edition fine art often either holds its value or increases in value over time if the editions all sell, so there is low risk in your investment and a high potential ROI depending on a number of factors. Let’s dive into some of those factors below.

The Value of the Artist

The value of the photographer is subjective and open to interpretation, but there are a few things you can consider when evaluating whether or not an artist might be worth buying from. The value of the artist might be one of the most important aspects of making your investment decision, so listen carefully!

- What galleries have they been hosted in or competitions have they won? This will give you a sense of their experience as well as how successful they’ve been in the eyes of different tastemakers.

- Where are they now? Because many artists have several phases to their career, it’s important to understand where they are currently before investing in fine art photography:

- If the artist is just starting out, they may have an extreme amount of upward potential but a higher risk of your investment not panning out as well. Also, with newer photographers, your initial investment may be quite affordable and could grow exponentially!

- If the artist is well established, your entry cost may be very high and your investment may accrue at a slower pace, but there will be less fall-out risks involved since you can track how this well-established artist’s pieces have done in the market.

- How does this artist fit into their local art community? Artists who participate in exhibitions with other artists gain exposure that helps them build relationships with other artists and collectors, which is helpful for any newcomer trying to establish themselves within an industry already dominated by established veterans.

Rarity of Photographs

When investing in fine art photography, rarity is a factor that has a large impact on value. The more rare a photograph, the more likely it will be worth more money. This is because there are only so many copies of each image available for sale, and once they sell out any future collectors will need to pay a premium to one of the original purchasers of that piece.

So to state the obvious, a limited edition print is more valuable than an unlimited edition print because there are fewer copies available and therefore less competition for them in the market.

Certificates of authenticity can also increase the price of photographs by adding to their perceived value and ensuring their legitimacy. If you are investing in fine art photography be sure to contact the artist and have them include a signed certificate of authenticity with every purchase so you can prove the value of your print for decades to come.

Look for Enduring Quality

When investing in fine art photography, you want to look for the following qualities:

- Artist with a strong following and/or long track record.

- Artists known for their quality and integrity.

- Unique style and vision (or unique perspective). What makes this photographer special in your eyes? Likely that trait will be viewed as valuable by many others

- Aligns with your values. For example, are you environmentally conscious? Then pick a photography printing sustainably or working with conservation projects to protect the planet!

- Consistency and Commitment – talk with the artist and learn more about their long term goals. This will tell you a lot about how the value of your investment could accrue as the artist accomplishes his or her goals over the coming years.

Local Up-and-Coming Artists vs. Renowned Talent

When deciding whether to invest in a local up-and-coming artist or a renowned talent, there are many factors to consider. Firstly, it is important to note that local artists are more likely than their esteemed counterparts to be affordable and accessible. This can also mean that they may be more innovative and adaptive as well since they are still less-known. Additionally, these artists tend to produce pieces that reflect unique perspectives on life – something you might not find with established artists who have been making art for some time now.

The greatness of art is not to find what is common but what is unique.

-Isaac Bashevis Singer

However, if your goal is simply to make money from your investment portfolio in the shortest amount of time possible then it may be worth investing in an established artist whose work has already gained recognition within the industry (or even globally). In this case, you’re likely looking at a faster return on your investment, sort of like a stock trade. Regardless of which route you choose, remember to do your research and due diligence before investing in fine art photography.

How to Find Art Works to Invest In

- Look for local artists – start by googling for artists in your area, contact local galleries, and uncover anyone in your city or town that is already forging a career as a fine art photographer.

- Find artists who are known for their particular style of work – do you like landscape photography? street photography? how about monochrome nature photography? Some artists these days are hyper specific in the work they do, so look for a style you like and would love to see in your home.

- If you want to start investing in fine art photography online, great places to start are Pinterest and Instagram. Many fine art photographers post their work on their pages, and you can DM them directly to talk about their goals and develop a relationship before choosing to invest.

- Begin networking – build a contact list of artists you find both in person and online. Organize their contacts and begin tracking their work. Once you have your prospects, look for trends and try to find the best time to buy your first piece!

When Should I Sell a Work of Art?

Now that we’ve covered the basics of uncovering artists and qualifying who and what you want to buy, let’s look at when you should sell. After all, investments are ultimately to make money, not about hoarding!

If you have decided to sell a work of art, check the current market value of another edition of your same piece, or if there are none compare the value to another piece from the same artist. Be sure to consider the size of the print, the original market value of the art, the value you bought the piece for, and the number of total editions of your piece and the piece you are comparing it to. These will all factor into the perceived market value of the work you intend to sell.

Vision is the art of seeing what is invisible to others

– Jonathan Swift

There is no one “best” way to do this, as everything is relative to the specific work you’d like to sell, so for the purpose of this post let’s keep it as simple as possible. You don’t want to sell your work at a loss unless you need the liquidity, so be sure to wait until the editions have sold out or another similar work from the artist has sold at a price higher than the price you bought for.

Once an artist’s pieces are coveted by collectors and museums all over the world, they can be sold for much more than they were worth when they were first created. These moments are the perfect time to sell, so stay in touch with your artist through email or social media and when they gain prestige, get ready to sell.

Another potential sell point for work from up and coming artists is to sell once all of the editions of the work sell. Now, instead of having a piece that someone else could purchase from the artist, you have a piece that can only be purchased from you or another one of the collectors who purchased.

Building a long-term investment strategy that works

Trust your instincts when purchasing new artists. You may not know how much an artist’s work will appreciate, but you can make educated guesses based on their current market value and the quality of their work. If an artist’s style is unique or has particular appeal for collectors, then he or she may be worth investing in, even if his or her career is just beginning. After all, many iconic artists were once unknowns before they became famous—and their prices rose accordingly!

Track the markets you’re participating in to find the best times to buy, hold, or sell. For example, if there are several auctions coming up that seem promising (with high estimated values), then it might be a good time to invest if you think those estimates are accurate and that these works will sell quickly enough at auction so as not to lose potential profits.

An artist is not paid for his labor but for his vision.

-James Whistler

If you are new to investing in fine art photography, build your network of artists and plan each purchase with a long time frame (think 5 years or more). What if a new up and coming artist you invest in, a few years later, becomes a National Geographic contributor, or wins a prestigious competition? If you’re still holding that piece you purchased for a few hundred dollars, you could soon be selling in for thousands.

The best way to invest in fine art photography is by following a long-term strategy. If you find the right artist, then your investment will likely increase in value over time. It’s important to remember that while there are many factors that can affect the value of an artwork, it’s ultimately going to be up to the market and supply/demand laws. So make a plan, think long-term when deciding who to invest with, do your due diligence, and treat all of your fine art investments as a portfolio.

Who knows, maybe you’ll find the next Warhol and strike gold! Only time will tell.